Unlock the secrets of successful trading with our comprehensive FREE Trading Course designed for traders of all levels. Learn proven strategies, risk management techniques, and market analysis tools to elevate your trading game. Start today and gain the skills to trade confidently in any market!

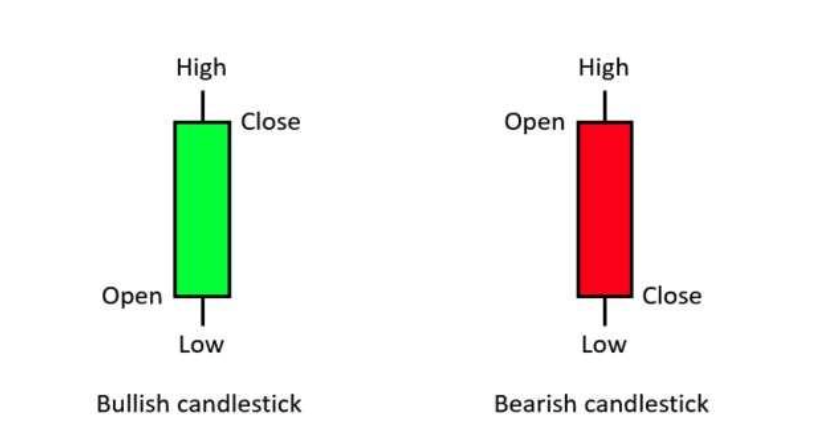

Each candle has its own story and, of course, its meaning. Recognizing the type of candle is very important as it indicates the intentions of the market. It does not matter to know the names of each type, but it is good to understand their meaning. Let’s start.

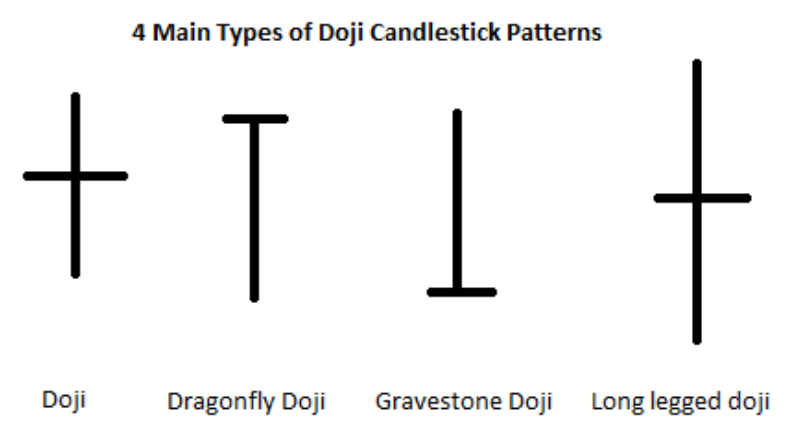

• DOJI: As you can see, DOJI candles are famous for not having a body. It is characterized by two long shadows, the lower one and the upper one and a body whose closing and opening points are very close, if not the same. The four types of DOJI candles are shown in the image below. The DOJI is an essential candle as it indicates that the market is undecided; neither the buyers nor the sellers have the upper hand. They are considered candles of indecision.

SPINNING TOP: The Spinning Top is another candle that indicates indecision. It is characterized by two long shadows and a smaller body; also, in this case, it is found at the end of a trend.

Like the DOJI candle, the Spinning Top is also a candle that indicates a possible trend reversal. As always, wait for confirmation. Trading is a game of patience; don’t rush!

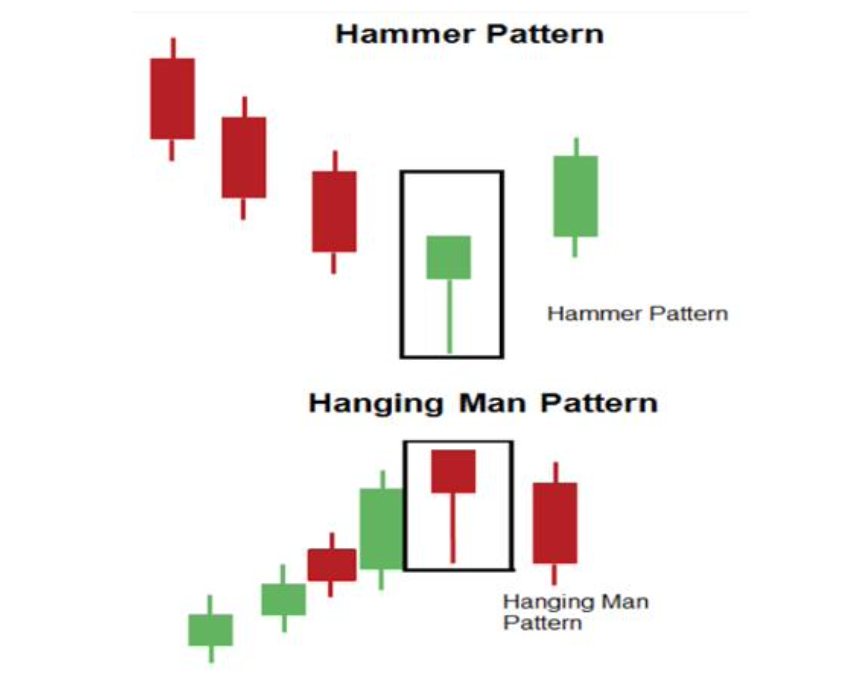

THE HANGING MAN: The Hanging Man is a candle that, if red, indicates a Bull market. It consists of a body and a very long lower shadow. It occurs after an ascending trend, suggesting it is time to bet on the descent. A red body forms it, and its shadow is directed towards the new market trend, the downward one. On the contrary, if you find it after a downward trend, it is time to buy, but the shadow will be turned upwards. It can be considered a candle of indecision. Be aware that it is a candle with a completely different meaning from “hammer”!

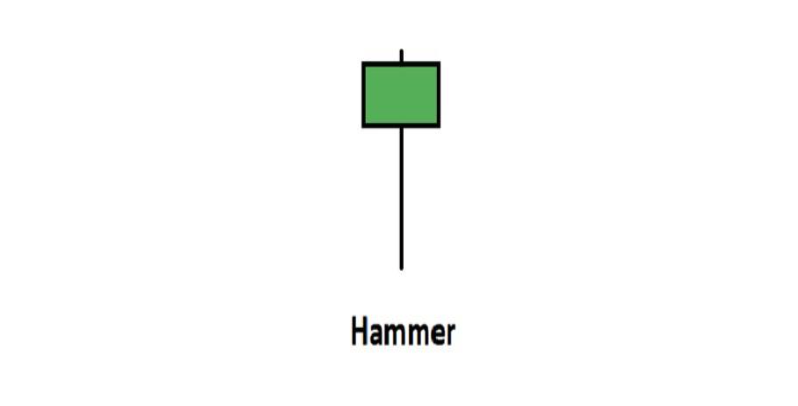

THE HAMMER: “The Hammer” and “The Hanging Man” have the same shape but opposite meanings.

Unlike the Hanging Man, the Hammer indicates an upward trend and is found at the end of the downward trend. Its shadow is not directed towards the new trend but towards the bottom. It can be considered a candle of indecision. Remember to always wait for a confirmation before entering!

SHOOTING STAR: The Shooting Star candle indicates descent; it has the same function as the Hanging Man, but its shadow faces upwards. We can define it as the opposite of the Hammer with the functionality of the Hanging Man. A body and a huge upper shadow form it. We find it at the end of an ascending trend. It can be considered a candle of indecision.

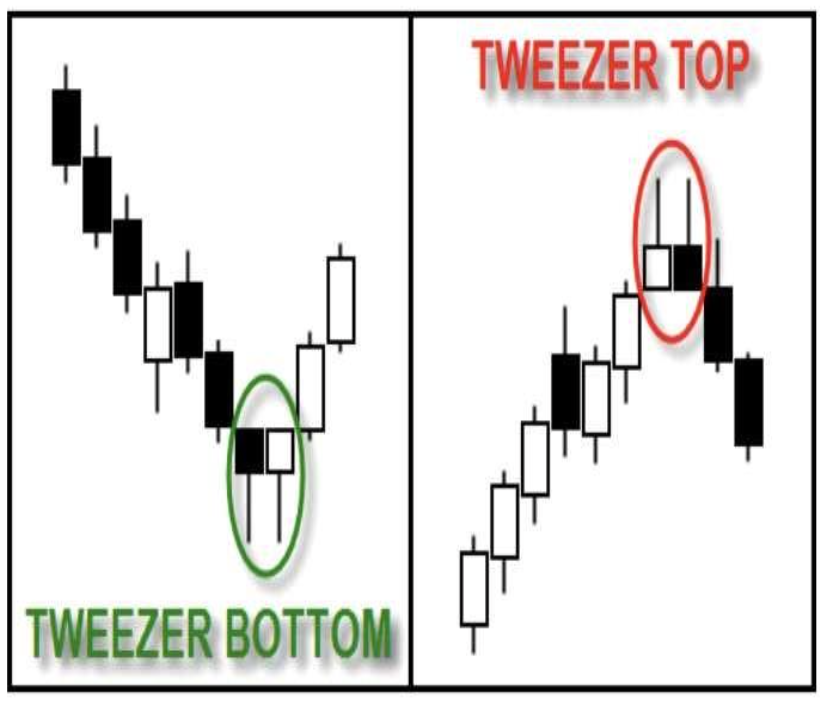

TWEEZER TOPS AND BOTTOMS: The Tweezer tops and bottoms are two patterns formed by two candles. This combination is found after a large upward or downward movement. The two candles are very similar, have the same body size and very similar shadows. It’s a very strong pattern but not super easy to find. It indicates market trend reversal; please always wait for confirmation with the next candle.

MARUBOZU: The Marubozu Candle is the strongest candle of all. It indicates that buyers or sellers are in the complete majority, and the trend will continue in their favour. This type of candle has only the body; the shadows are absent. It is essential to know that this candle has value with a high time frame, 1h / 4h / 1D. This candle indicates a continuation of the trend; if the Marubozu candle shows an ascending trend, it is time to buy; if the candle is red, it shows a descending trend. The higher the time frame, the more valid the candle will be.

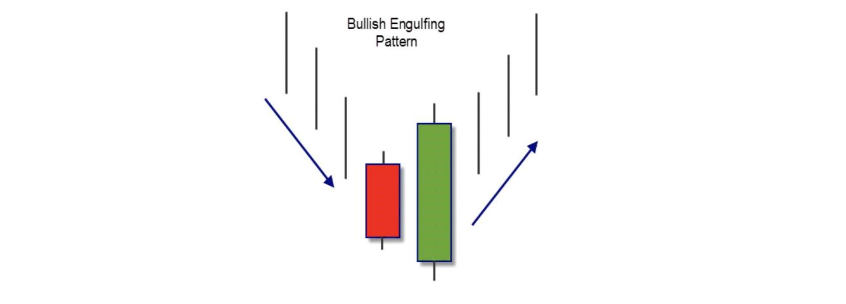

BULLISH ENGULFING PATTERN: The Bullish Engulfing Pattern occurs at the end of a downtrend at the support level; in the next chapter, I will explain what it is. One last red candle will be covered entirely with a green candle. This pattern indicates a change in the direction of the graph. Please, a confirmation is required after the Engulfing candle.

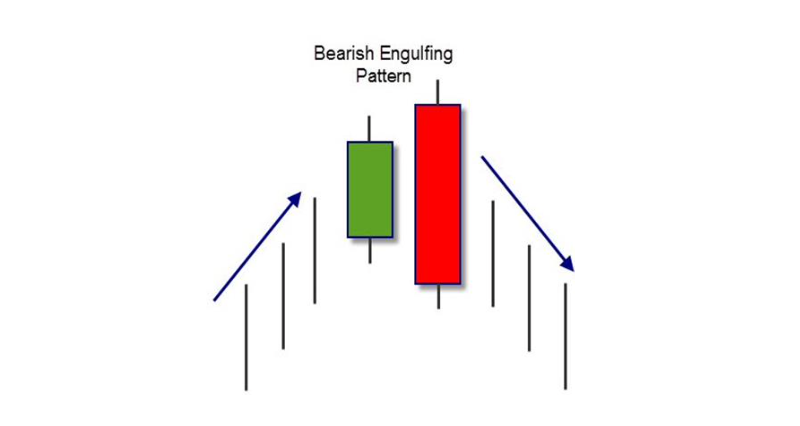

BEARISH ENGULFING PATTERN: The Bearish Engulfing Pattern can be considered the opposite of the Bullish Engulfing Pattern. We find it after an ascending trend, which means the change of direction of the movement from bull to bear. This pattern is also formed by a red candle covering the last green candle.

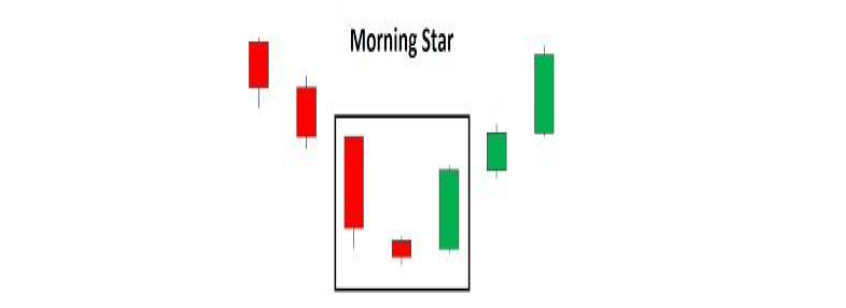

THE MORNING STAR: This pattern is made up of three candles. We find it at the end of a descending trend, indicating a rise in the trend. It comprises a last bearish candle, a DOJI and a green candle that covers 50% -70% of the first candle.

As we can see, after the formation of the pattern, it is necessary to wait for a confirmation before entering the market with a “buy”. Don’t rush.

THE MORNING STAR: This pattern is the opposite of the Morning Star. It is also made up of three candles, but we no longer find it in a descending trend but in an ascending one. The pattern is formed by a green candle, a DOJI and a red candle covering 50% -70% of the first.

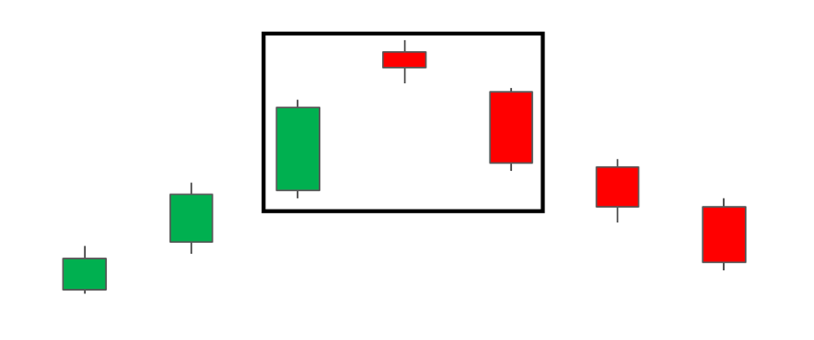

THE INSIDE CANDLESTICK FORMATION: This pattern is very easy to find. It is formed by a mother candle that incorporates the next candles. It is elementary as a pattern because when the mother candle is broken, it will follow the trend.

Congratulations! Now you know all the possible candlestick patterns, it’s time to take the first steps!

“The secret to being successful from a trading perspective is to have an indefinite and tireless thirst for information and knowledge.”

Paul Tudor Jones

Share it:

Join the thousands of traders who have changed their lives Thanks to our instantly funded accounts

Don’t wait any longer, the perfect moment is NOW.